The Money Calculator That'll Simplify Your Finances

By:

Personal finances can be confusing. Should you pay off your credit card or stash money into investments? Should you build six months of emergency funds in your savings account first, before you even try to tackle the former? Financial literacy isn't always easy but there's a new tool from the investment management firm Morningstar that can help provide some guidance.

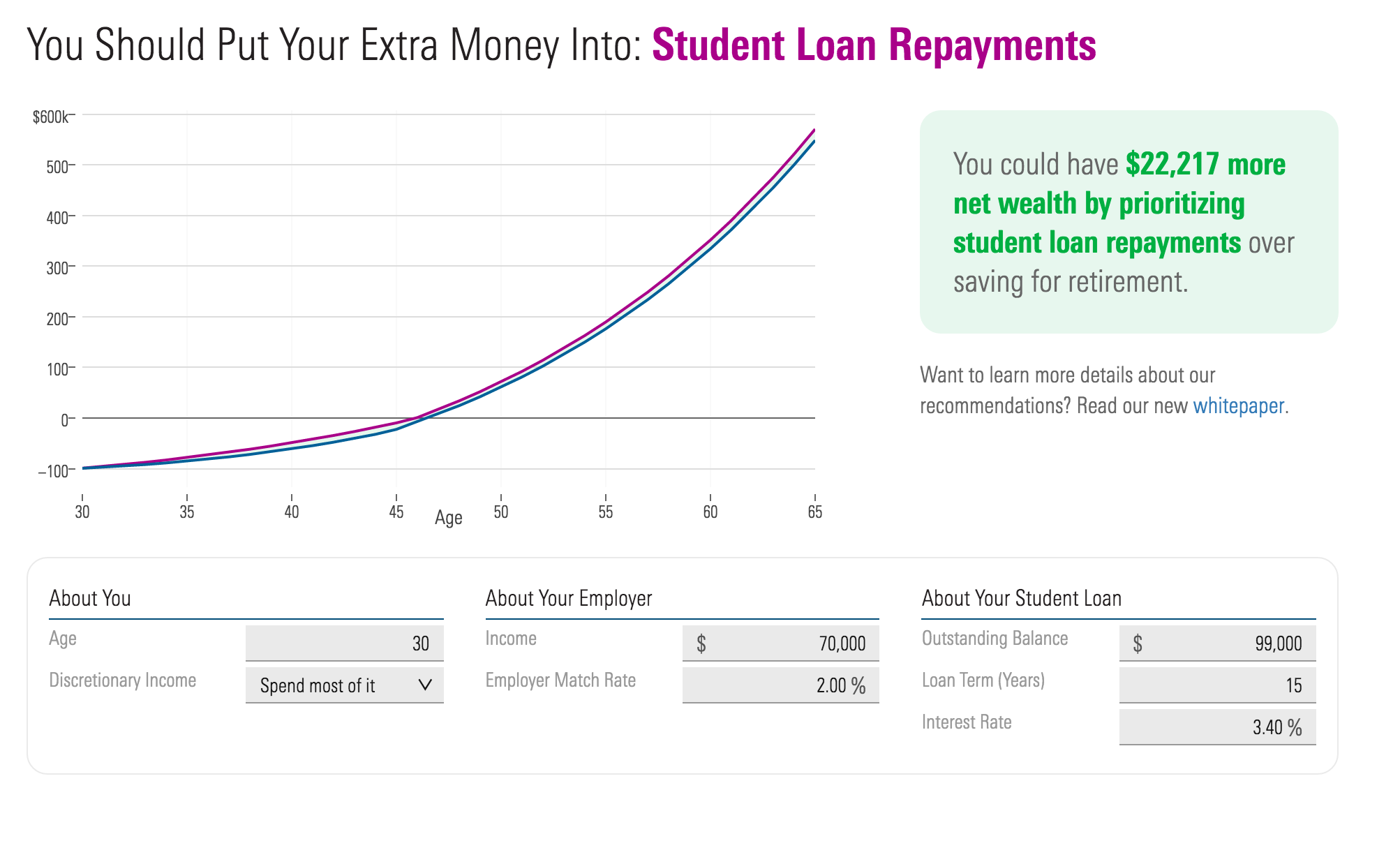

Morningstar’s new calculator allows Millennials to see whether it’s more effective to pay down their debt or to put their money towards in retirement accounts. Some people can do both, and this handy calculator can give you specifics.

All you need to do is plug in some basic information.

After taking into account your age, income, student loan interest rates, and how much an employer will match retirement investments, the tool calculates how much higher your net wealth would be by prioritizing either loan repayments or retirement investment.

.

.

For most, getting rid of debt will be the most prudent decision.

The average graduate of the class of 2016 is entering the professional world strapped with $37,172 in student loan debt, according to Student Loan Hero. Debt isn’t at all unique to that group. 42 percent of Millennials reported that they or someone in their household had student loan debt, in a survey conducted by Harvard University’s Institute of Politics. As finance advisor Remit Sethi notes in the video below, you should prioritize investing in retirement only "if your debt interest rate is lower than what interest rate you can expect from investing."

However, there are those that believe that investing in retirement as early as possible is best. As personal finance blogger Jessica Moorehouse told ATTN: "Ideally you’d start in your 20s. If not, start saving in your 30s. If you’re just starting to save for retirement in your 40s or later, then you may have some difficulty."

But you might also want to take advantage of a retirement account in certain situations.

If you're lucky enough that your job matches what you put into your retirement account, the calculator might suggest you shift some money that way; it's pretty much getting free money and doing nothing. It's important to remember though that everyone's situation (income, interest rates, etc) and priorities are different so the tool is only a general guide.

If you're able to budget for both goals, this practice will serve to help you in the long-run. Today, though, most young adults are by far better off dealing with the mountain of debt before them and, like the act of buying a home, will have to tackle retirement once they've chipped off some loan payments.