Nicki Minaj Has Every Broke College Student Showing Her How Much Money They Owe

By:

Nicki Minaj pledged to give away a total of about $20,000 to roughly 30 college students and recent graduates after announcing an impromptu scholarship contest on Twitter Saturday.

BigStock/kathclick - bigstockphoto.com

BigStock/kathclick - bigstockphoto.com

Though the artist was initially promoting a contest to meet her at the Billboard Music Awards, Minaj got a reply from a follower asking her to help him pay for his college tuition.

She responded: "Show me straight A's that I can verify w/ur school and I'll pay it. Who wants to join THAT contest?!?"

A lot of people wanted to join that contest, evidently.

And it makes sense given the rising costs of higher education, and the average college graduate in the U.S. left school with $30,000 in student debt in 2015, according to the Institute of College Access and Success.

Fans asked the pop star to help them cover different costs, including outstanding tuition balances, summer classes, student loans, textbooks, and even a camera for an audiovisual media student. She retweeted 30 stories in all and promised to follow up with payment details over direct message.

@NICKIMINAJ I only owe $700 for my online class. No family support, minimum wage job. It would be a great help Nic 🙏🏾 please

— Lee Minaj™ (@_MINAJstan) May 7, 2017

Minaj concluded by tweeting that she'll hold another giveaway in a month or two.

The contest might not have solved the country's college affordability crisis, but it called attention to the problem and highlighted how financial obstacles can prevent people from pursuing higher education.

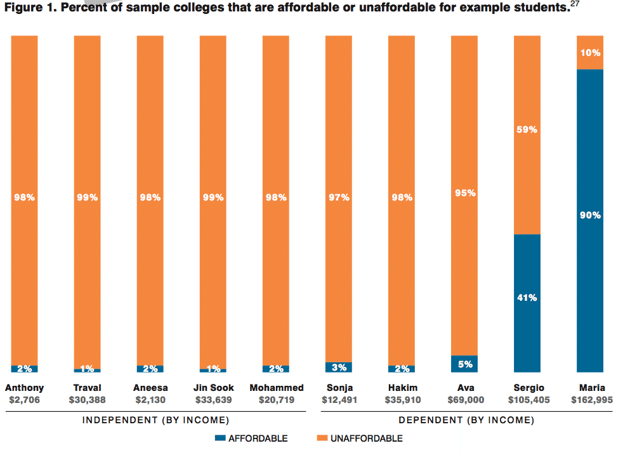

College tuition for private and public schools is rising at a rate that's forcing many prospective students to put it off or consider alternatives such as full-time employment after high school. In a recent report, the Institute for Higher Education Policy found that about 95 percent of U.S. colleges are unaffordable for students from low or middle-income families.

IHEP - ihep.org

IHEP - ihep.org

Those numbers improved slightly when researchers factored in subsidized federal student loans, but while those loan options include lower interest rates and more flexible repayment plans, it still means leaving college with debt for most students. The total amount of student debt nationally was a record $1.3 trillion in 2016, Inside Higher Ed reported, and 11 percent of those borrowers had either defaulted or were over 90 days late on payments.